|

With the notable exception of Boris Johnson's provocative remarks about prosecco, public discourse on the impact of Brexit on the wine industry has been rather limited.

But what will Brexit mean for the occasional consumer who enjoys the odd glass of chardonnay? What are the implications for multinationals like London-based Diageo, the world's largest manufacturer of spirits? And for the millions in between who have some stake in wine production, distribution and consumption, what can they expect of a post Brexit drinking environment? To these questions (and others), I'm hoping to gain some insight at this year's Vinitaly Verona.

Vinitaly Verona 2017

Vinitaly Verona is a major international wine fair and one of the most important dates in the industry's calendar. Now in its 51st year, Verona has been hosting an annual wine festival since 1967. From modest beginnings, the fair now boasts 4120 exhibitors from 27 countries. Last year over 49,000 visitors (of whom 28,000 were registered buyers) from 140 countries attended. If you buy or sell, import or export Italian wine, Vinitaly is the place to be. At this year’s conference, the impact of Brexit on the wine industry is high on the agenda. Despite obvious uncertainties about future market conditions, UK interest in Italian wine remains undiminished. In fact, this year over 400 new buyers from the United Kingdom will be attending Vinitaly Verona for the very first time.

The UK - a key player?

The UK is a key player in the world’s wine and spirit trade, a position it has occupied since Roman times. In the Middle Ages wine was England’s largest single import, whisky distillation was documented in Scotland as early as the 15th Century, and Berry Brothers and Rudd, the iconic London wine merchant, is the oldest continually operating wine and spirits merchant in the world, having been in existence since 1698. Now worth over £45 billion and supporting nearly 600,000 jobs, the wine and spirit sector makes a significant contribution to the UK economy. UK spirits, mainly whisky but also gin, are a key export good. In terms of both volume and value, the UK is the world’s second largest wine importer - only Germany imports more and only America spends more on wine. As both an importer (of wine) and exporter (of spirits), the European market is crucial. Forty-five per cent of all spirits exported from the UK are shipped to the EU.

English wine - a taste of the future?

While 99% of wine drunk in the UK is imported, the rise of the English wine sector has been a surprising success story of recent years. At this crucial point in its development the uncertainties of Brexit loom large. Although exports of English wine account for just 25% of total sales, access to European wine making and specialist vineyard management equipment, as well as unrestricted access the European workforce, are crucial to the ongoing viability of English wine. Furthermore, vine growing and wine making are classified as agricultural practices and therefore benefit from the EU’s much criticised Common Agriculture Policy. Questions remain over the future of such funding streams post Brexit. Now that article 50, the mechanism that kick-starts the Brexit negotiation process, has been triggered, the wine industry must begin to wake up and smell the Muscat. Theresa May and Brexit ministers want to agree bespoke free-trade deals for individual industrial sectors, such as the automotive and pharmaceuticals industries, but the EU has already dismissed the idea of sector-by-sector deals. Alex Cannetti, Director of Berkmann Wine Cellars, the UK’s leading independent wine agent/wholesaler, will be leading a discussion on prospects for Italian wine in the retail channel in Great Britain after it leaves the EU. Speaking ahead of the event, Cannetti stated that "The only solution to this threat [Brexit] is to allow the United Kingdom a period of 10 years during which it will share the same trading conditions and the same customs charges as the EU, as well as negotiating a free trade agreement".

The benefits of Brexit

While British exit from the European Union undoubtedly presents challenges for the UK's wine and spirit trade, Miles Beale, Chief Executive of the Wine and Spirit Trade Association (which represents over 300 companies producing, importing, transporting and selling wine and spirits), believes there are also opportunities to be exploited. A key plank of the leave campaign was to sweep aside the 1000s of EU regulations said to be choking British business. In fact, the WSTA believes that the current EU regulatory framework for food law is fit for purpose and should be rolled over into UK. Furthermore, the WTSA also supports the maintenance of EU production standards and labelling rules which, it argues, protect consumers and producers alike. EU rules on the definitions of distilled gin, for example, provide protection against inferior products. Final word on the impact of Brexit on the wine industry to Giovanni Mantovani, CEO & Director General of Veronafiere, the sprawling conference complex where Vinitaly Verona is hosted: "it is too early to predict what will happen as regards our wine in the world's second largest importing country but I think that putting a brake on sales would be to everyone’s detriment". Indeed, for industry insiders on both sides of the channel, Brexit must not be allowed to disrupt the free flow of wine and spirits into and out of the UK. Such an outcome really would be hard to swallow. More from Vinitaly Verona... |

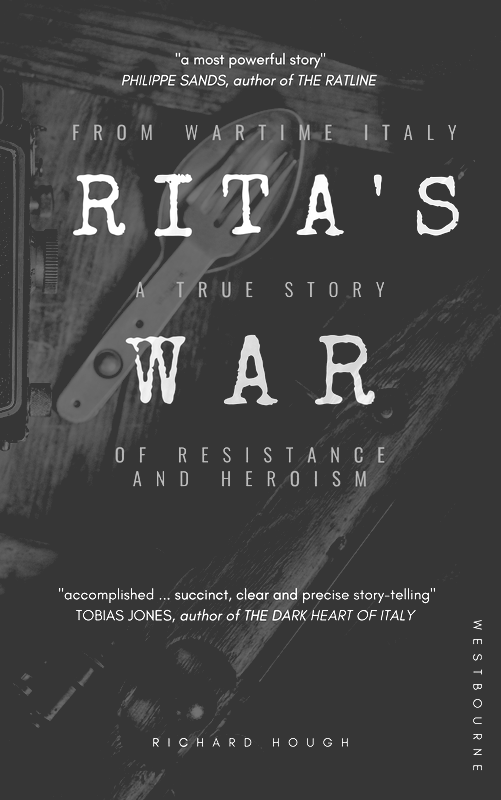

AboutRichard Hough writes about history, football, wine, whisky, culture + travel and is currently working on a trilogy about wartime Verona.

|